Contents

Charles is a nationally recognized capital markets specialist and educator with over 30 years of experience developing in-depth training programs for burgeoning financial professionals. Charles has taught at a number of institutions including Goldman Sachs, Morgan Stanley, Societe Generale, and many more. Libertex MetaTrader 5 trading platform The latest version of MetaTrader. Libertex MetaTrader 4 trading platform The #1 professional trading platform. Research & market reviews Get trading insights from our analytical reports and premium market reviews. FAQ Get answers to popular questions about the platform and trading conditions.

This interest is called rollover in forex, and it is calculated using the interest rates of the two currencies involved in the trade. For tax purposes, the currency trader should keep track of interest received or paid, separate from regular trading gains and losses. Conversely, a trader will need to pay interest if the currency they borrowed has a higher interest rate relative to the currency that they purchased. Traders who do not want to collect or pay interest should close out of their positions by 5 P.M.

Whereas the forex swap fee is stable under normal situations, increased credit risk puts pressure on interbank rates directly affecting rollover forex swap on different days. Alternatively, you can easily inquire about rollover commission at the rollover counter in your bank. However, you can avoid unnecessary calculations and quickly get swap fee at the forex trading platform or the broker‘s websites. Rollover credit occurs when interest rates of a long currency are higher than that of a short currency. Similarly, rollover debit results if the long currency’s overnight cost is lesser than that of a short currency. Select ‘Properties’ and you will be presented with details regarding that Forex pair including your swap rates for both long and short trades.

Rollover in Forex Positions

In the spot markets, we already learned that traders take delivery of the underlying currency two business days later. The current price of each currency is supported by interest rate differentials, which in turn influence rollover rates. Apart from this, it is likely that rates will also fluctuate as a result of future changes to market fundamentals.

For example, on Monday all position with value date of Wednesday (in case of T+2) will be rolled over and the value date will be updated for Thursday. Position with value date of Friday will be updated with value date of next Monday. Therefore in many cases, traders will have to write to the broker’s support channel to understand how the swap long and swap short points are calculated. Day trading is when the trades are open and closed within the day.

Understanding the concept of forex rollover and how it works will help you strategies effectively your trades. Most banks are closed on Saturday and Sunday; hence rollover is not applicable on these two days. However, the banks will still charge rollover commission on these two days. The daily gain or loss from rollover might seem very small, but they could accumulate over time. As a result, you may want to add rollover to the list of things you check before you enter a position, especially if you are holding it for a long time.

Rolling Over FX Positions

Once you are ready, enter the real market and trade to succeed. Subtracting the interest rate of the base currency from the interest rate of the quote currency. It will definitely convince you to conduct your trading with Libertex. If you’re in Tokyo, positions are rolled over at 6 am the next day.

However, the banks book an extra day to charge rollover fees two working days prior to the holiday. Rollover rates displayed are based on a 10K position and estimated based on the previous rollover rate and number of days being rolled. For example, typically Wednesdays are rolled for three days to account for the weekend. You can find rollover rates in the Market Information Sheets on any of our trading platforms. In forex, a rollover means that a position extends at the end of the trading day without settling. Most forex trades roll over daily until they close out or settle.

How to withdraw the money you earned with FBS?

As a point of reference, « target » interest rates are established exclusively by a country’s central bank for their domestic currency and released to the public. Target rates are widely viewed by short-term traders as ballpark estimates of the actual interest rates that will be used in determining the ig broker review rollover value for a specific trade. If you know you’re going to see a positive rollover rate and you want to continue trading, then leave positions open. You should keep track of central bank rollover dates since they will help you anticipate sudden jumps in interest rates based on these dates.

- When the trade settles, it’s considered the value date, meaning when either party in the transaction receives or pays home currency in exchange for foreign currency.

- When conducting a transaction with banks in other countries, banks deal with foreign currencies and pay the interbank rate.

- Rollover rates are based on the interest rate differential of the two currencies and the spot price.

- There is no way to get out of avoiding rollover fees unless you have a verified sharia account or just a day trade.

The rollovers are conducted using eitherspot-nextortom-nexttransactions. A rollover debit, on the other hand, is paid out by the trader when the long currency pays the lower interest rate. The trader thus makes money when he is on the positive side of the interest rollover payment. Additionally, there are special conditions for holidays because of the banks. A holiday rollover normally takes place two days before the holidays. For example, before the US President’s Day on 18 February, the rollover is calculated at 5 pm two days before that for all US dollar pairs.

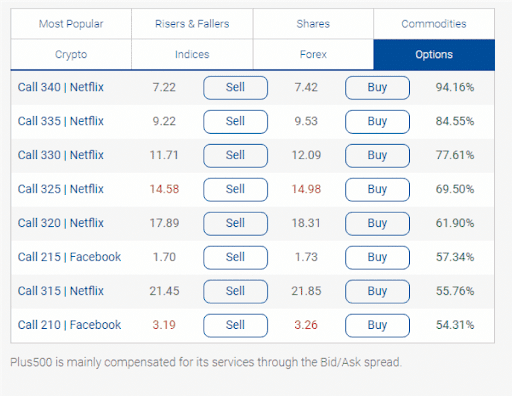

Zero commission fees for trading any crypto CFD

If you roll the Wednesday position over to Thursday, the Swap rate will also account for rolling the position over the weekend – thus the triple rate. For example, when the rollover would be applied on the weekend. For more information about the FXCM’s internal organizational fxchoice review and administrative arrangements for the prevention of conflicts, please refer to the Firms’ Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here.

What Is The Difference Between Trading And Investing?

Thus, it is needed to subtract the interest rate of the base currency from the quote currency’s interest rate. Then, it is needed to divide the result by 365 times the base exchange rate. But what is considered the end of the day if the working hours of the forex market spread across different time zones? In this 24-hour market, the community had agreed upon what is considered the end of the trading day. You can access the Market watch window in MT4 and right-click on the currency pair. Then click on specifications which opens the specification window in your trading terminal.

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. The NZD overnight interest rate per the country’s reserve bank is 1.75%. Full BioSuzanne is a content marketer, writer, and fact-checker. She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands. A direct transfer is a transfer of assets from one type of tax-deferred retirement plan or account to another. Non-spouse beneficiary rollover is performed in the event of the death of the account holder where the recipient is not the spouse of the deceased.

Forex rollover is the amount of interest that you will either be credited or debited if you are still holding an open trade at the end of the trading day. In the forex market, rollover is the process of extending the settlement date of an open position. In most currency trades, a trader is required to take delivery of the currency two days after the transaction date. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

We strive to keep your trading costs low by sourcing institutional rollover rates and pass them to you at a competitive price. When trading a currency you are borrowing one currency to purchase another. The rollover rate is typically the interest charged or earned for holding positions overnight. A rollover interest fee is calculated based on the difference between the two interest rates of the traded currencies.

Leave positions open if you know the rollover rate is likely to be positive and if you want to continue with the trade. An indirect rollover is a payment from a retirement account to the investor for later deposit in a new account. In the case of a 60-day rollover, funds from a retirement plan or IRA are paid directly to the investor, who deposits some or all of the funds in another retirement plan or IRA within 60 days.

But when it comes to the rollover fees, this annualized interest rate is broken down to the exact number of days for which your trading position is kept open. The swap rollover is based on the interest rate differential. ifc markets review This is applicable because when you trade in the currency markets, you are simultaneously buying one currency and selling the other. An important thing to bear in mind is when the rollovers are charged.

Lastly, keep in mind each broker will rollover at different times and also have different swap rates. Whether you are credited or debited will depend on the Forex pair you are holding. You do not pay or receive any rollover interest unless you are holding an open position at the day’s end.