Forex news trading is an integral part of the trading landscape, providing savvy traders with opportunities to capitalize on market volatility. In this article, we delve into the principles of Forex news trading and provide actionable insights that can help traders refine their strategies for success. For more resources, visit forex news trading trading-jo.com.

Understanding Forex News Trading

Forex news trading involves making trades based on economic news and events that can impact currency valuations. Traders often focus on key announcements related to interest rates, employment statistics, inflation data, and geopolitical events. The rationale behind this strategy is that such news releases can create significant price movements, allowing traders to enter and exit positions at profitable levels.

Key Economic Indicators to Watch

There are several economic indicators that traders consistently monitor when engaging in news trading:

- Interest Rates: Central banks’ decisions regarding interest rates have a direct influence on currency value. An increase in interest rates usually leads to currency appreciation.

- Non-Farm Payrolls (NFP): This US employment report is released every month and provides a gauge of economic health. A better-than-expected NFP can lead to a surge in the USD value.

- Consumer Price Index (CPI): CPI measures inflation and is critical for gauging economic stability. High inflation can prompt central banks to adjust interest rates, affecting currency prices.

- Gross Domestic Product (GDP): GDP growth rates reflect the health of a country’s economy. Strong GDP growth can lead to currency appreciation.

- Trade Balance: A country’s trade balance influences currency values as it measures the difference between its exports and imports. A surplus can lead to currency strengthening.

Preparing for News Releases

Effective news trading begins with a solid preparation strategy. Here are some steps to ensure you are ready for the news:

- Build an Economic Calendar: Use an economic calendar to keep track of upcoming news releases and their historical impact on the market.

- Understand Market Sentiment: Gauge how traders might react to specific news. Historical data on how similar events impacted market movements can provide insights.

- Set Up Alerts: Use trading platforms to set up alerts for specific news releases that are likely to impact currencies you trade.

Strategies for Trading News

Several strategies can be employed when executing trades based on news announcements:

- Straddle Strategy: This involves placing both a buy and sell order around the news release. Depending on the market’s reaction, one of the orders will get triggered, capturing the volatility.

- Fade the Move: Some traders prefer to bet against the immediate reaction of the market after a news release, anticipating a retracement.

- Use of Limit Orders: Instead of entering the market at the moment of news release, traders can use limit orders to enter at a desired price after the volatility subsides.

Managing Risk in Forex News Trading

Risk management is paramount in Forex news trading due to the unpredictable nature of market reactions to economic news:

- Use Stop-Loss Orders: Always set stop-loss orders to limit potential losses. This is especially crucial during high volatility periods.

- Position Sizing: Adjust the size of your positions based on your overall capital and the risk you are willing to assume. This prevents significant losses during volatile swings.

- Avoid Overleveraging: Leverage can amplify gains but can also increase losses significantly. Use leverage judiciously.

Evaluating Your Trades

Post-trade analysis is vital for continuous improvement in Forex news trading. Consider evaluating the following:

- Outcome vs. Expectation: How did the actual news release compare to your expectations? Did the market behave as you anticipated?

- Emotional Responses: Reflect on your emotional state during the trade. Did fear or greed impact your decision-making?

- Identify Patterns: Look for patterns in successful and unsuccessful trades to adapt your strategy moving forward.

Integrating Technical Analysis with News Trading

While news trading focuses on fundamental analysis, integrating technical analysis can enhance decision-making. Here’s how you can incorporate technical tools into your trading routine:

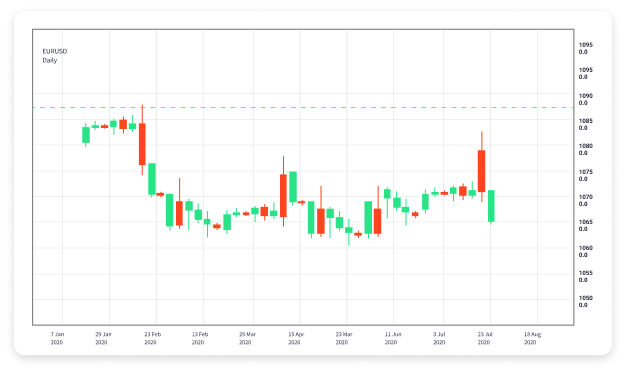

- Trend Lines and Support/Resistance Levels: Before major news events, analyze current price action to identify key support and resistance levels that could impact price following a news release.

- Chart Patterns: Recognizing chart patterns can provide additional confirmation for your trade setups. Patterns like flags or head-and-shoulders can indicate market sentiment ahead of news releases.

- Indicators: Using indicators like moving averages or the Relative Strength Index (RSI) can help you gauge market momentum and improve entry or exit timing.

Conclusion

Forex news trading offers a dynamic and potentially lucrative way to engage with the currency markets. By understanding key economic indicators, preparing effectively, employing sound strategies, managing risks, evaluating trades, and integrating technical analysis, traders can navigate this complex landscape with greater confidence. As you refine your approach, remember that practice and continuous learning are crucial in the ever-evolving world of Forex trading.

COMMENTAIRES