Contents:

This is a tool to help identify the direction of the underlying trend. Also, the Dow Jones Utility Average is not part of Dow Theory and did not exist when Charlie was writing his editorials in the Wall Street Journal. But we do look at it regularly and it is included in the Dow Jones Composite Average, which we also rely heavily on. January 14, 2000, was when the Industrials made their all-time highs while the Transports were already well into a bear market.

Dow’s lower low triggers Dow Theory sell signal – MarketWatch

Dow’s lower low triggers Dow Theory sell signal.

Posted: Fri, 23 Sep 2022 07:00:00 GMT [source]

It teaches investors to read a trading chart to understand what is happening with any asset at any given moment. The analysis of maximum and minimum market fluctuations is used to predict the direction of the market. With this simple analysis, even the most inexperienced can identify the context in which a stock or an index is evolving. According to Charles Dow, the importance of these upward and downward movements is their position in relation to previous fluctuations.

Trend Analysis

The Dow Theory advocates caution, insisting that a possible reversal be confirmed by comparing indexes. The primary trend is the long term trend that identifies where the market is in it’s cycle. The primary trend’s influence trickles down on all market behavior while it’s in motion.

- This implies that there is no need to investigate further why assets are priced the way they are but to act on price movements and volume and depend on signals and confirmation for trend reversals.

- In a bear market, the phases are the distribution phase, public participation phase, and panic phase.

- It says that all available information is already reflected by the current price from company earnings to macro economics.

- Pessimism, which was excessive at the end of the bear market, still reigns at the beginning of a bull market.

Much of technical analysis—finding patterns and trends based on market behavior and investor psychology—derives from Dow’s belief that markets move in trends. Dow, who died in 1902, used the analogy of the ebb and flow of tides to describe how the market acts. He believed that stocks move in trends, similar to how waves crash onto the beach, and leave patterns in the sand to show where high and low tides occurred.

Trade the Dow Theory Trend with AvaTrade

Ideas like uptrends, downtrends, support and resistance got their start from Dow Theory. Not only did Dow believe that the movements of the 2 averages must confirm each other, he also thought that volume for 1 or both averages must confirm the trend. For example, if a stock rises and volume rises , that means volume has confirmed the uptrend. Similarly, if a stock declines and volume rises, that means volume has confirmed the downtrend.

The financial media rarely has anything good to say about it, and word has gotten out that the company, in the case of a stock, has been struggling. If the Dow Jones Industrial Average climbs to a milestone, the Dow Jones Transportation Average is expected to follow the upward trend. When a reversal in the primary trend is signaled by both the Industrials and Transports, the odds of the new trend continuing are at their greatest. However, the longer a trend continues, the odds of the trend remaining intact become progressively smaller. The following chart shows how the Dow Industrials registered a higher high (point « A ») and a higher low (point « B ») which identified a reversal of the down trend (line « C »).

Stock Market Cycles

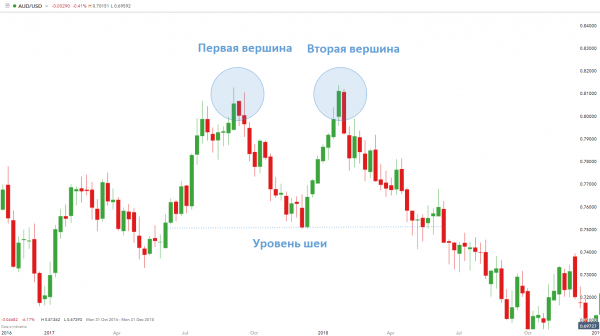

Likewise, in a double top formation, the stock attempts to hit the same high price twice but eventually sells off. Of course, the time gap between the two attempts of crossing the high should at least be 2 weeks. In the chart below , we can notice the double top at 336 levels. On close observation, you will notice the first top was around Rs.336, and the second top was around Rs.332. With some amount of flexibility, a small difference such as this should be considered alright. A double top & double bottom is considered a reversal pattern.

A referral to a stock or commodity is not an indication to buy or sell that stock or commodity. Your results may differ materially from those expressed or utilized by Warrior Trading due to a number of factors. We do not track the typical results of our past or current customers. As a provider of educational courses, we do not have access to the personal trading accounts or brokerage statements of our customers. As a result, we have no reason to believe our customers perform better or worse than traders as a whole.

This is where smart investors saw that the crash had been priced in, negative sentiment was at a high, and began buying. Many traders go against this belief and trade stocks based on rumors and news. An example of a hype and news drive stock is Riot Blockchain , which was a biotech company that decided to venture into blockchain technology. A market principle that Dow lived by was that all information known about a stock or index is already discounted and reflected in the price of the asset.

Dow Theory Suggests Caution – Investing.com

Dow Theory Suggests Caution.

Posted: Mon, 21 Nov 2022 08:00:00 GMT [source]

The first phase of primary trends determines that informed investors profit from an accumulation phase or a distribution phase . Traders then move towards a second public participation phase, which is when the largest price movement occurs. Finally, the market experiences a third excess phase, characterised by a period of euphoria , or of panic/despair . Through the writings of Dow and Hamilton, Rhea identified 4 separate theorems that addressed trend identification, buy and sell signals , volume and, lastly, trading ranges. The first two were deemed the most important, serving to identify the primary trend as bullish or bearish.

Averages Discount Everything

We want to see the internals improving and breadth measures bottoming. The future leaders of the next Bull Market are born during this period. The ones who don’t make that final low or two that the rest of the market seems to be making will be the leaders. Accumulation—The first is the accumulation phase, where a stock, for example, has been beaten up. The sentiment at this point is generally extremely pessimistic.

Accumulation – After the preceding bear market, the valuation of assets is still low as the market sentiment is predominantly negative. Smart traders and market makers start to accumulate during this period, before a significant increase in price occurs. Bull markets are broad upward movements of the market that may last several years, interrupted by secondary reactions. Bear markets are long declines interrupted by secondary rallies.

The reality of the situation is that nobody knows where and when the primary trend will end. The objective of Dow Theory is to utilize what we do know, not to haphazardly guess about what we don’t know. Through a set of guidelines, Dow Theory enables investors to identify the primary trend and invest accordingly.

However, when adjusted for risk, the Dow Theory system outperformed buy-and-hold over the past 18 years. Keep in mind that 18 years is not a long time in the history of the market. The Dow Theory system was found to under-perform during bull markets and outperform during bear markets.

Here are 3 ways you can get fresh, actionable alerts every single day. This article will go over the basics of Dow Theory, and how traders can leverage it in the modern market. The views expressed are as of the date indicated and may change based on market or other conditions.

While there are those who may think that the market is different now, a read through Rhea’s book, The Dow Theory, will attest that the stock market behaves the same today as it did almost 100 years ago. TheDistribution Phaseoccurs when the astute investors that bought during the accumulation phase of the previous bull market start to sell their holdings. Trading activity is usually still high during this phase but is starting to decrease. Finally, when the institutional investors completely sell off their holdings, there would no further support for prices.

The information ranges from specific company news, such as earnings reports and management changes, to macroeconomic factors like monetary policy and the global economy. Furthermore, future events, such as economic news releases, have also been factored into the current price. This is also the philosophy of technical analysis, and it conflicts with the principles of fundamental analysis and behavioural economics. The Dow theory was fundamental to technical stock market analysis and acted as the underlying principle for its continued advancement.

Conversely, an https://forexhero.info/ is considered in place until a lower low forms and the ensuing decline exceeds the previous low. An uptrend began with the Oct-98 lows and the DJIA formed a series of higher highs and higher lows over the next 11 months. Twice, in Dec-98 and Jun-99 , the validity of the uptrend came into question, but the uptrend prevailed until late September. (The Dec-98 price action is addressed below.) There were lower highs in Jun-99, but there were never any lower lows to confirm these lower highs and support held. Any bears that jumped the gun in June were made to sit through two more all-time highs in July and August. The change in trend occurred on September 23 when the June lows were violated.

The 2nd https://traderoom.info/ begins when the economy starts to prosper and as it does, companies benefit and start reporting increased earnings. This, in turn, entices more stock buying, raising the market higher. Though it gives a broad idea about trend identification, one must also use other technical analysis tools to confirm trends and reversals. Dow believed in that the laws of action and reaction apply to the markets just as they do to the physical universe. He wrote, “Records of trading show that in many cases when a stock reaches top it will have a moderate decline and then go back again to near the highest figures. If after such a move, the price again recedes, it is liable to decline some distance” .

• https://forexdelta.net/ trends remain in effect until a clear reversal occurs. As such there will be exceptions to the theorems put forth by Hamilton and Dow. They believed that success in the markets required serious study and analysis that would be fraught with successes and failures. Failures, while painful, should be looked upon as learning experiences. Technical analysis is an art form and the eye grows keener with practice.

COMMENTAIRES